This is the third entry in our series 7 Signs Your Policy Admin System is Reaching its Limits. (For our first two articles, click here: 7 Signs Your Policy Admin System is Reaching its Limits – Sign #1 and 7 Signs Your Policy Admin System is Reaching its Limits – Sign #2.)

Policy admin systems are essential. Once a system is in place, insurers loathe the thought of replacing it. Many systems have been in use for decades.

Insurers have adapted their old systems over the years to respond to change – but adaptation has its limits. Layer upon layer of changes makes a policy admin system brittle and unstable.

Every tool has a finite useful life. Insurers who wait too long to replace their legacy policy admin system risk damaging their business.

We’ve identified seven warning signs that a policy admin system is reaching its limits.

Warning Sign #3: Do you feel like you don’t have

the information you need and are flying blind?

Do you have to wait for reports to run to get access to key performance metrics? How long does it take to produce monthly and quarterly reports – days? Weeks? Is reporting a tedious process – with many manual calculations, reconciliations, and serious spreadsheet work?

Are you limited to basic, backward-looking financial indicators? Do you wonder if your financial indicators are accurate?

Is the process of planning and preparing what-if scenarios and projections so labor-intensive and time-consuming that it can only be done once a year?

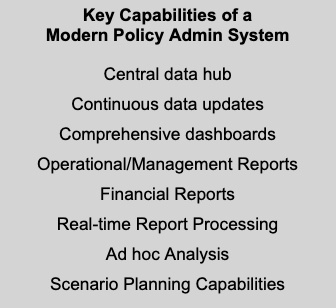

A healthy PAS will equip insurance leaders with key information for informed decisions by:

- Giving instant access to financial and management reports.

- Generating monthly and quarterly financial and regulatory reports in a fraction of the time – minutes instead of days

- Providing persona-based dashboards and rapid ad-hoc reporting to gain business insights beyond standard financial measures

- Enabling go-forward projections and what-if analysis to inform key decisions

An out-of-date policy admin system will have you waiting for reports, analysis, and critical insights (or unable to obtain them) before making key decisions.

If the limitations of your current policy admin system are making your key decisions feel like guesses, this is a warning sign that action is needed.

For more information on this and other warning signs that your policy admin system is reaching its limits, and what to do about it, click below to download the complete eBook 7 Signs Outdated Policy Administration is Damaging Your Business:

Or tune-in next week for Warning Sign #4. To get started today in exploring a modern policy admin system, visit www.britecore.com and schedule a BriteCore product demonstration.